California Electronic Cigarette Excise Tax (CECET) | Vape Tax

Beginning July 1, 2022, electronic cigarette retailers are required to collect from the purchaser at the time of sale, a California Electronic Cigarette Excise Tax (CECET) at the rate of 12.5 percent of the retail selling price of electronic cigarettes containing or sold with nicotine.

This article will show you how to create this new tax and add it to the appropriate Products.

Step 1: Create Tax

Navigate to Setup > Store > Tax. Click NEW. Enter the details of the new tax. See the example below. When finished, click SAVE and CLOSE.

Step 2: Apply Tax to Products

From the Main Menu, navigate to Data > Inventory > Products. Click FIND to locate a Product that the new tax would apply to. Click EDIT. Next to an available (unused) tax, click the folder icon and select the new tax. Click SAVE followed by CLOSE. See the example below.

Step 3: Sell Product

Once the changes above have been made for all your applicable Products, at each POS click the green SYNC icon on the Main Menu to accept your changes.

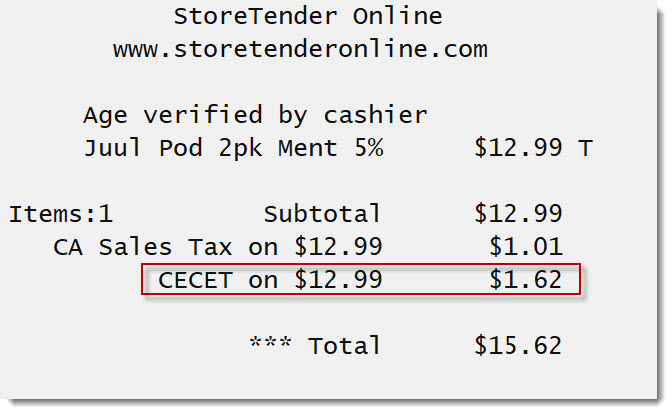

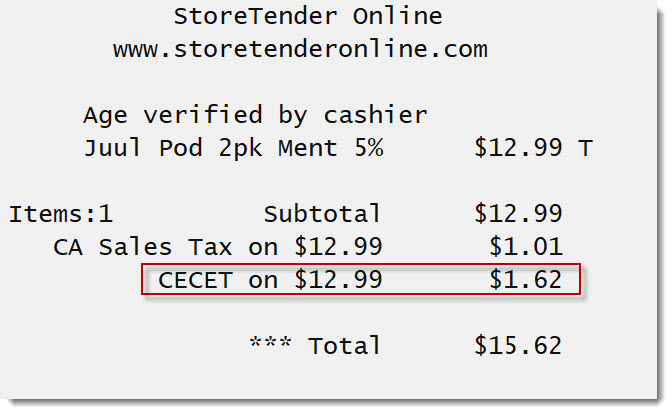

You can now sell your electronic cigarettes and the new tax will apply. See the below receipt example.