Partial Authorization Mandate

MasterCard and Discover have implemented rule changes that require merchants in the U.S. to support Partial Payment Authorization. Aloha Data Systems is here to guide you through this change with a comprehensive explanation of what this means for you as a merchant.

A brief summary of the process is that when a debit card is swiped and has insufficient funds, transaction processing terminals will now accept a partial authorization. As a merchant you need to pay attention to this. You then need to confirm with the customer if they are capable of paying the remaining balance. If they can, you complete the partial transaction and then finish with a transaction for the remaining balance. If they can not, you need to reverse or void the charge. If that seems a bit complicated, don’t worry, here’s the entire process in detail.

What does Partial Authorization mean?

A Partial Authorization occurs when an authorization is attempted for the full amount of the transaction and there are not enough funds available to cover the full amount, so an authorization for the amount available in the account is returned. This allows the cardholder to use the card presented for the amount available and for the merchant to obtain an additional form of payment for the difference. For Prepaid Gift Cards, the issuers will also return a card balance which will be printed on the receipt.

What types of cards will partial authorizations occur on?

Partial Authorizations are primarily supported for debit cards (both Signature and PIN’d Debit) and Prepaid Card transactions since the issuers treat prepaid cards like debit cards. In some cases, Partial Authorizations are also supported for credit card transactions but the mandate addressed the debit and prepaid card transactions.

Are partial authorizations supported for all card brands/types?

MasterCard and Discover have mandated that acquirers support partial authorization transactions on debit and prepaid cards, where MasterCard has also defined specific merchant types that have to support partial authorizations and consumer requested reversals. Issuers still have the choice to return a partial authorization or reply with a decline. StoreTender's EMV integration supports partial authorization transactions on all card types including Visa and AMEX. There is no way to disable this support.

When does this go into effect?

The actual mandate went into effect in 2010, with implementation in October, 2011.

What does this mean for the merchant?

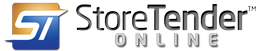

When a customer makes payment with a card that is authorized for an amount less than the amount due, StoreTender will display "Amount Due $x.xx" in the top right of the cashier screen and, if available, customer screen.

At this time, the transaction is not concluded. The receipt has not printed, nor has the cash drawer opened as it normally does when a transaction is finished. If you have turned off receipt printing or cash drawer opening on card media, and you do not trust your cashiers to take note of the payment status, we recommend turning these features on. It will give you physical notification that a transaction has concluded.

The customer must now make payment for the balance due with an alternate payment method. Below is an example of a $1.00 partial authorization. Note the "Amount Due" at the top right of the cashier screen.

My customer has no way to pay the balance. What do I do?

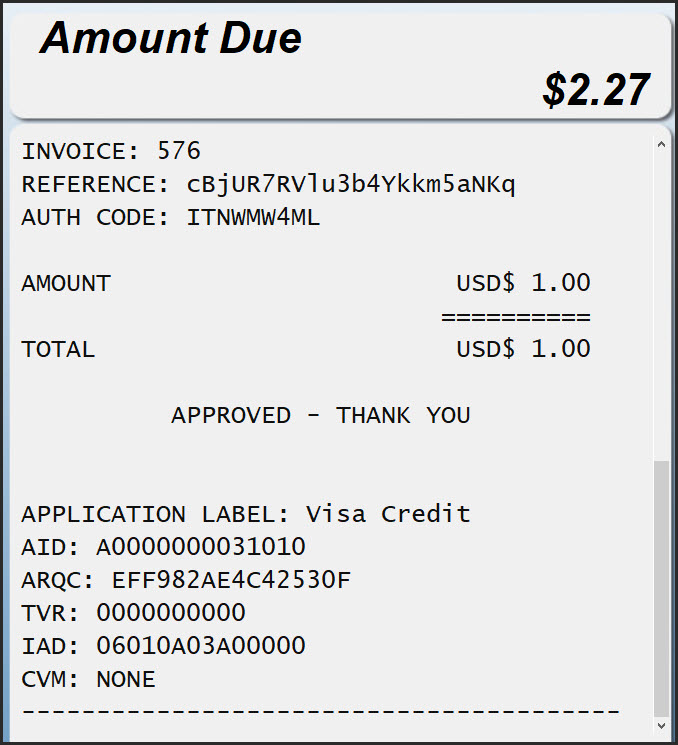

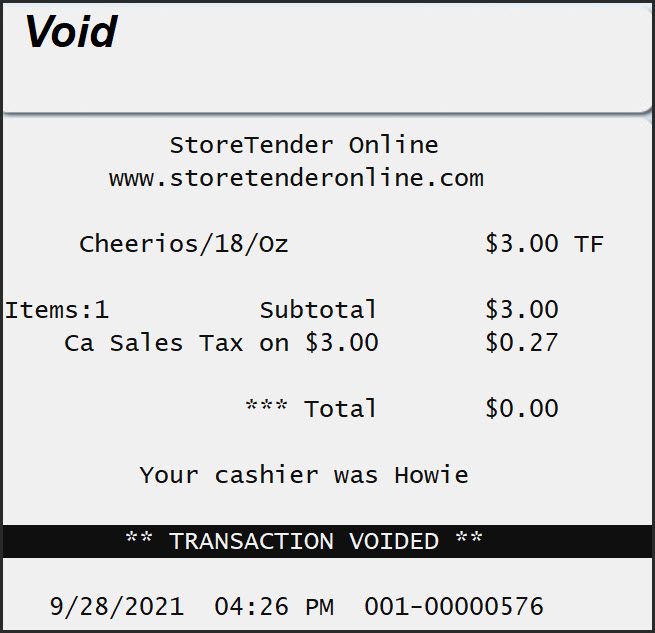

If your customer cannot pay the remaining balance, you will need to VOID the payment. This is accomplished by pressing the VOID button. This will cause the receipt to display the red Void lines on screen. Scroll up to the card payment method and touch it. This will Void the payment, erasing it from the screen. The authorization will not process at batch close, because it was voided. This may not immediately appear on the customer's banking account, but it is their bank that determines how long a "pending" authorization remains.

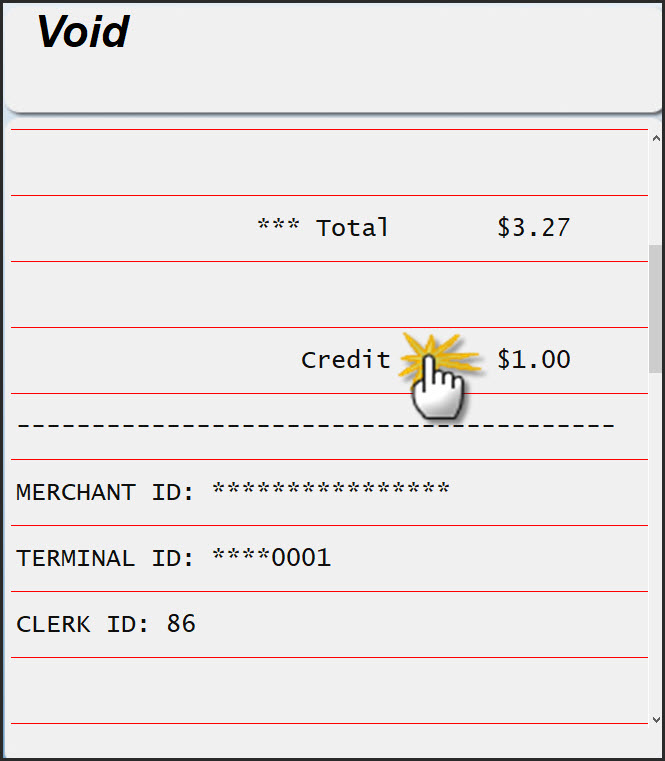

Once voided, the transaction screen will display as below.

Now that the payment has been voided, you can void the entire transaction by pressing Subtotal > Void.